Asset Turnover Ratio Standard

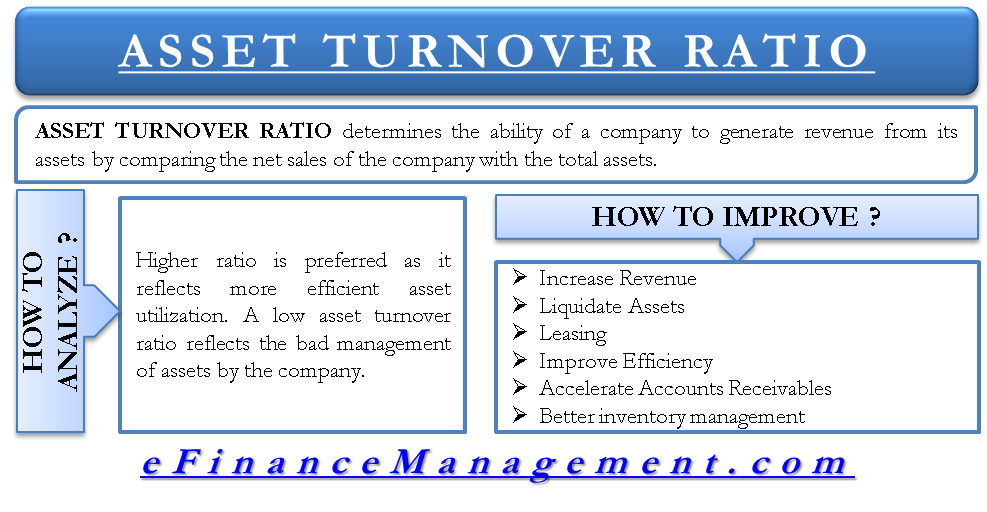

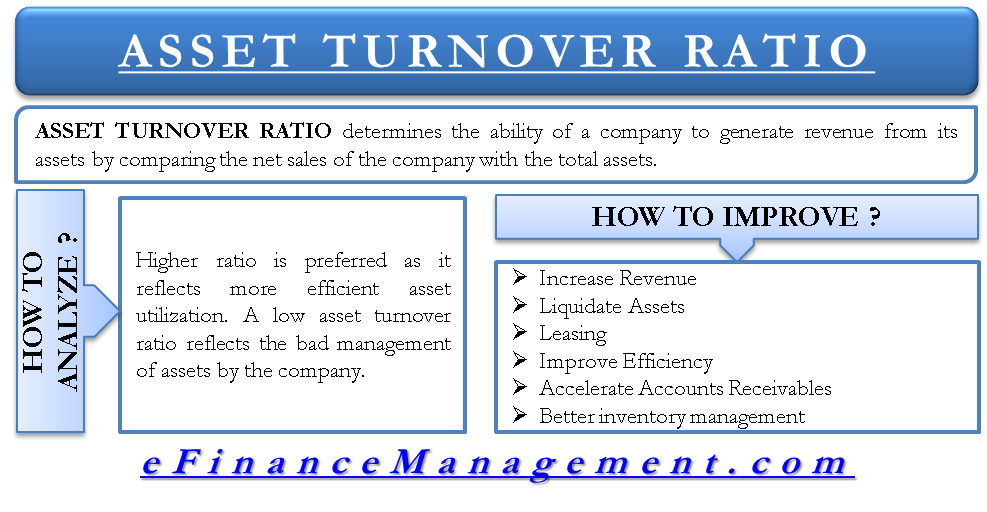

Calculate the net asset value. Thus asset turnover ratio can be a determinant of a companys performance.

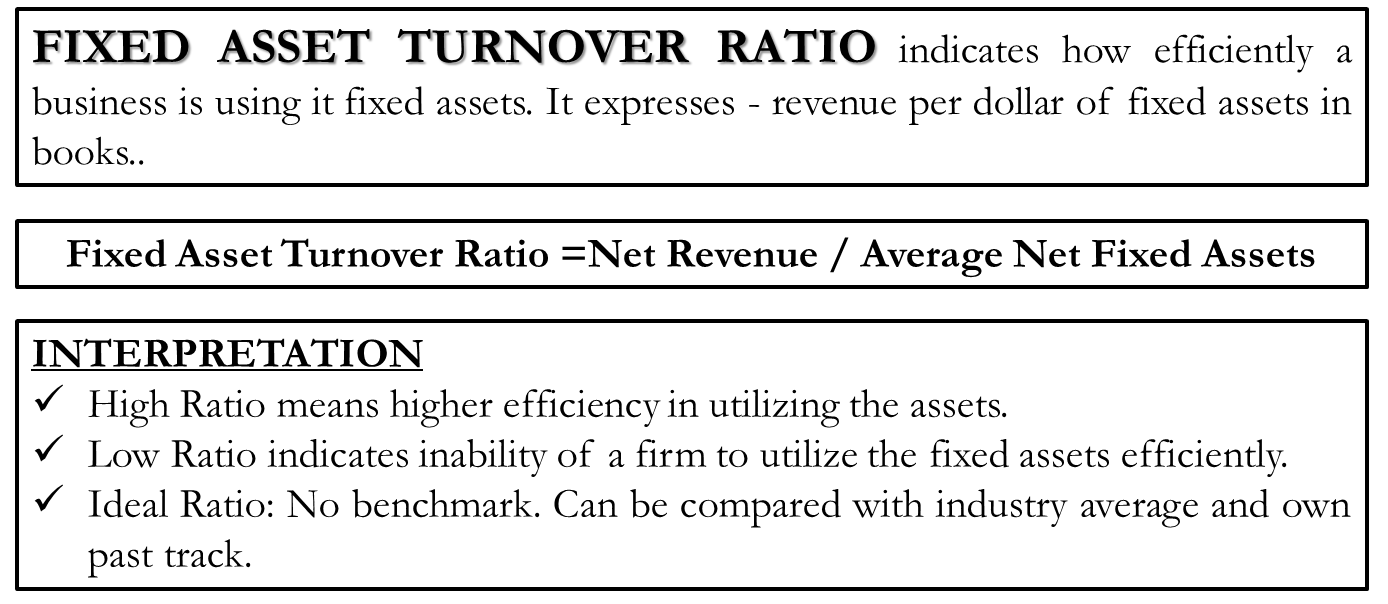

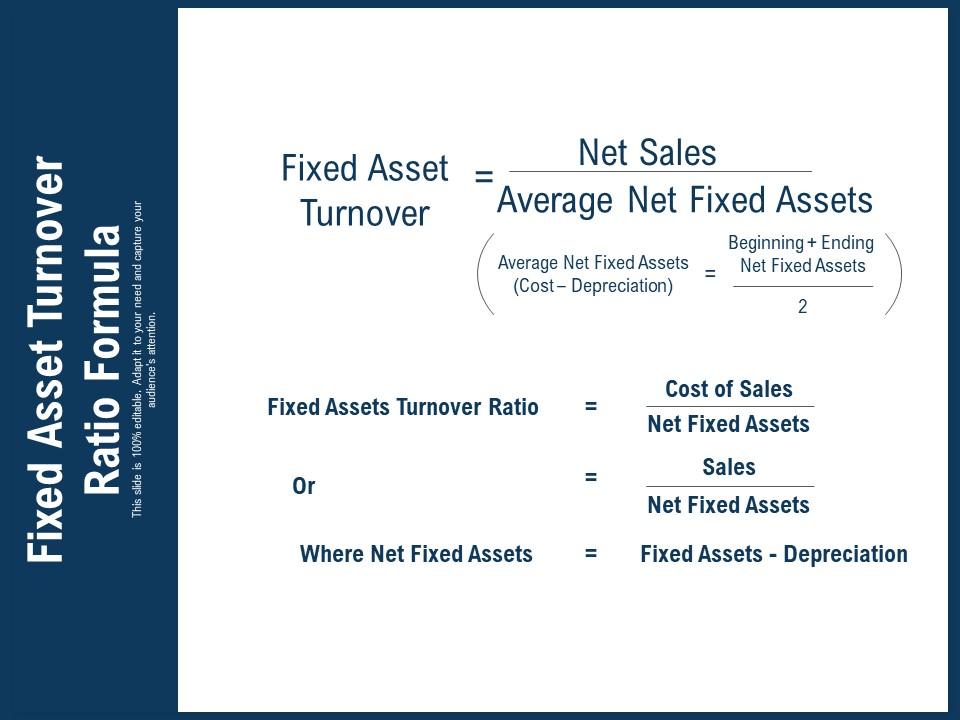

Fixed Asset Turnover Definition Formula Interpretation Analysis

A General financial and investment information including i basic investment concepts such as risk and return diversification dollar cost averaging compounded return and tax deferred investment ii historic differences in the return of asset classes eg equities bonds or cash based on standard market indices iii effects of.

. Dividend Payout Ratio Standard Deviation Compound Annual Growth Rate CAGR Discounted Cash Flow. To find the inventory turnover ratio. Trade payables turnover ratio or Accounts payable turnover ratio depicts the efficiency with which the business makes payment.

The expense ratio is an efficiency ratio that calculates management expenses as a percentage of total funds invested in a mutual fund. Explanation of Inventory Turnover Ratio Formula. Therefore the Net Asset Value of the fund stood at 2 per share at the close of the day.

Apple Inc Balance sheet Explanation. For more such interesting articles stay tuned to BYJUS. Get all the latest India news ipo bse business news commodity only on Moneycontrol.

The Bureau of Labor Statistics BLS publishes a range of indicators that point to the extent to which labor resources are being utilized. This concludes our article on the topic of Trade Receivables Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students. Fund details performance holdings distributions and related documents for Schwab US.

Advantages and Disadvantages of Ratio Analysis. It measures how much net income was generated for each 1 of assets the company has. Calculating Accounts Receivable Turnover.

This indicates that for company X every dollar invested in assets generates 4. Inventory Turnover Ratio Cost of Goods Sold Avg. What is an Expense Ratio.

The higher the ratio the better is the companys. Total assets turnover ratio of 128 times shows that net sales are above average total assets which are always favorable to have though it should be compared to previous years data as well as other players in the industry to have a complete analysis. The return on assets ratio ROA is considered an overall measure of profitability.

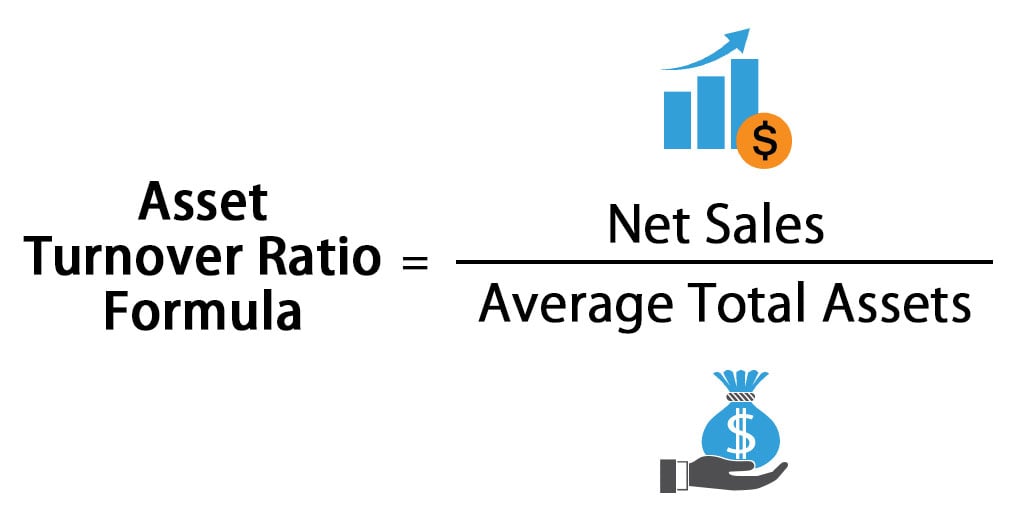

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Asset Turnover Ratio Net Sales Average Total Assets. The quick ratio is an indicator of a companys short-term liquidity and measures a companys ability to meet its short-term obligations with its most liquid assets.

Asset turnover ratio is the ratio between the value of a companys sales or revenues and the value of its assets. To calculate your accounts receivable turnover ratio divide your net sales by your average gross receivables. Cherry Woods Furniture is a specialized supplier of high-end handmade dining sets made from specialty woods.

Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product. The standard asset turnover ratio considers all asset classes including current assets long-term assets and other assets. Let us take the example of an investment firm that manages a larger mutual fund.

Dividend Equity ETF SCHD The funds goal is to track as closely as possible before fees and expenses the total return of the Dow Jones US. Asset Turnover Ratio 100000 25000. Fund details performance holdings distributions and related documents for Schwab SP 500 Index Fund SWPPX Review the latest SWPPX fund details performance holdings distributions and other related documents on our Schwab SP 500 Index Fund information page.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Days inventories outstanding 3496. Days inventories outstanding 365 1044.

Where Xi ith data point in the data set μ Population mean N Number of data points in the population Examples of Variance Formula With Excel Template Lets take an example to understand the calculation of the Variance in a better manner. The inventory turnover ratio can be calculated by dividing the cost of goods sold for a particular period by the average inventory for the same period of time. σ2 Xi μ2 N.

Difference Between Current Ratio and Quick Ratio. Over Q3 its busiest period the retailer posted 47000 in COGS and 16000 in average inventory. It is an indicator of the efficiency with which a company is deploying its assets to produce the revenue.

Asset Turnover Ratio 4. Ratio analysis is useful in the following ways. Get 247 customer support help when you place a homework help service order with us.

Known as U1 U2 and U4 through U6 U3 is the official unemployment rate these alternative measures of labor underutilization provide insight into a broad range of problems workers encounter in todays labor market. In other words measures the percentage of your investment in the fund that goes to paying management fees by comparing the mutual fund management fees with your total assets in the fund. Types of Financial Ratios.

Asset Turnover Ratio is calculated as. The formula for Turnover Ratio can be calculated by using the following points. The formula for a stock turnover ratio can be derived by using the following steps.

At the end of the day the following information is available for the mutual fund. This ratio is used to measure the number of times the business is paying off its creditors or suppliers in an accounting period. Use of Ratio Analysis.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Accounts payables are short term debts that a business owes to its suppliers and creditors. Total Assets A common variation of the asset turnover ratio is.

Net Asset Value Formula Example 2. Inventory Turnover Ratio Examples. Days in Inventory 365 Inventory Turnover Ratio.

ROA is a combination of the profit margin ratio and the asset turnover ratio. The profitability ratio can also be used to compare the financial performance of a similar firm ie it can be used for analysing competitor performance. Some of the most used profitability ratios are return on capital employed gross profit ratio net profit ratio etc.

Asset Turnover Ratio How To Calculate The Asset Turnover Ratio

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Fixed Asset Turnover Ratio Formula Powerpoint Shapes Powerpoint Slide Deck Template Presentation Visual Aids Slide Ppt

No comments for "Asset Turnover Ratio Standard"

Post a Comment